Overview:

The US-China trade war is now already into its third year. With COVID-19, a further negative narrative has started to build against China. A lot of western investors believe that the Chinese system will implode under its own weight. There is also a general perception that China’s relevance to the world will decline going forward.

We counter this view. We believe China is of immense relevance to the world – as the large contributor to world GDP growth, as a major exporter of Capital, as the largest producer of goods for the world. It has taken 20 years to get to its current position. It will take more than a few years to disrupt this position.

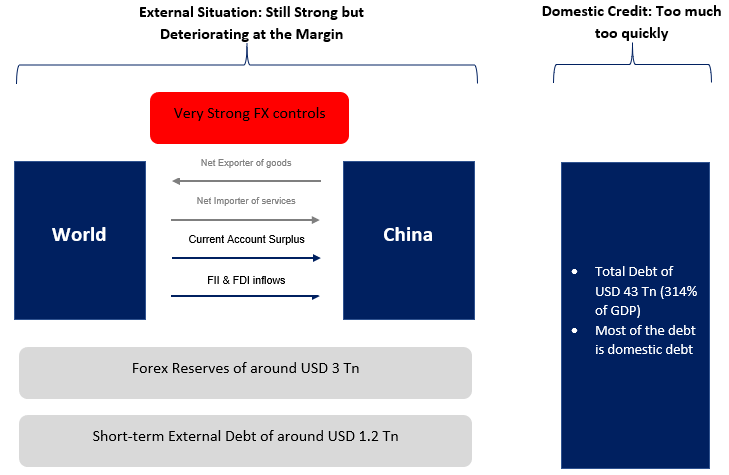

We argue that while there is a likelihood of a domestic credit crisis, it can be a controlled one (given a large quantity of credit is supported by domestic savings). We think China is very much in control of its external finances (which still looks strong with a strong Current Account Surplus). Hence, a large external debt crisis is unlikely.

China: A Significant Driver of the Global Economic Growth

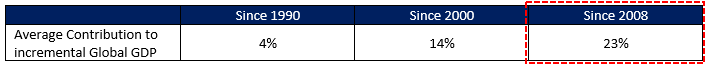

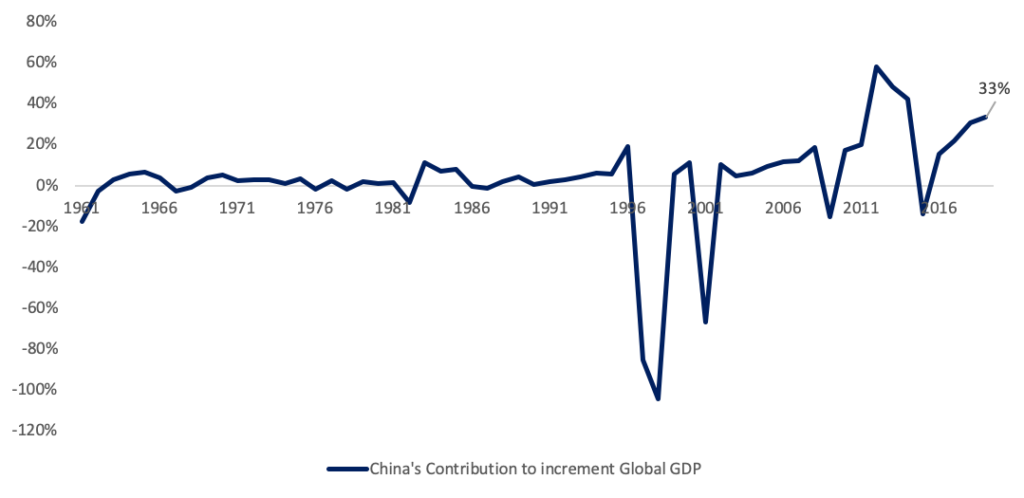

China has become an increasingly important entity in its contribution to the incremental GDP. Based on World Bank data, China contributed to roughly a quarter of world GDP growth. This number was 4% in 1990. It has really become a force to reckon with.

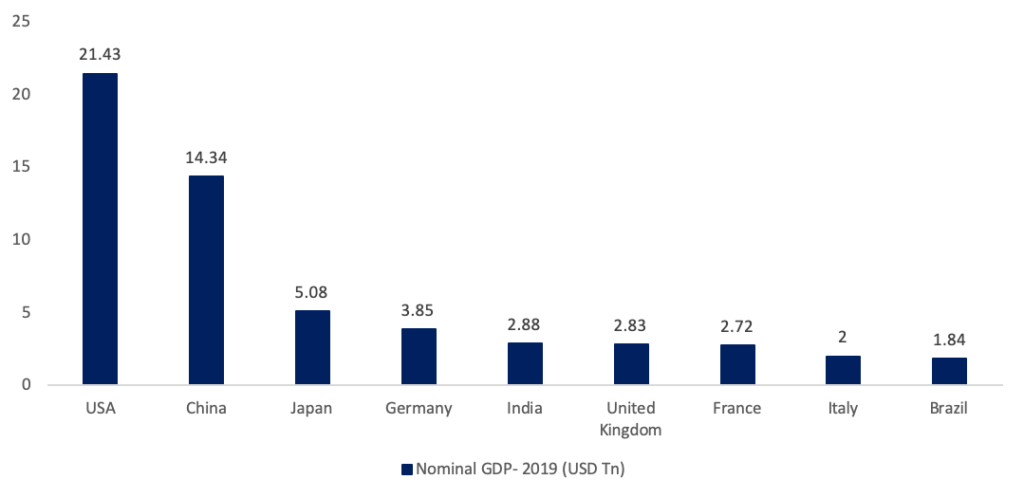

It is the world’s second largest economy in GDP terms.

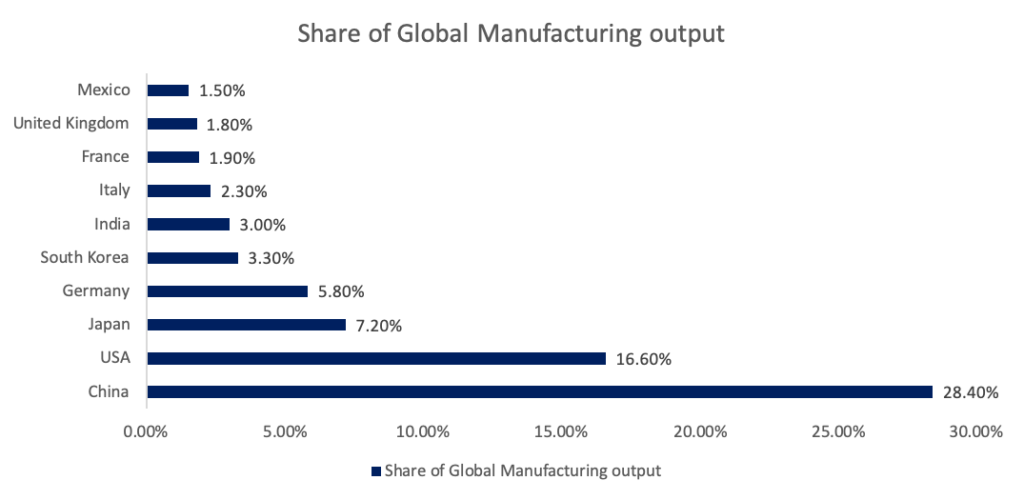

China is the manufacturing hub for the world. It overtook the U.S. as a manufacturing hub around 2010. China continues to be the supplier of most of the goods across the world.

Source: United nation statistics department

CHINA: A PERSPECTIVE

Let us look at the various aspects of the Chinese Economy.

China runs a different system vs. the other major economies. Its centralised, one party system has enabled seamless implementation of projects. The availability of cheap labour, utilities, land, and opening of factors of production has been the driving force for Chinese emergence as the manufacturing hub for the world.

The government has been building adequate infrastructure and capabilities for a while. These have attracted companies across the world to set up their factories in the country. The efficiency of getting things done and that too at a swift pace makes it difficult for the companies to shift out of China.

Over the past 20 years, Chinese contribution to global manufacturing and export of key products has increased to such a level that it would be almost impossible to replace the country. Countries like India, Vietnam, Taiwan, etc. may provide an alternative, but still, it won’t be easy for the companies to move out of China.

DOMESTIC ECONOMY: Exposed to credit bubbles but a “solvable” issue

| 1. DOMESTIC CREDIT: Has grown very fast |

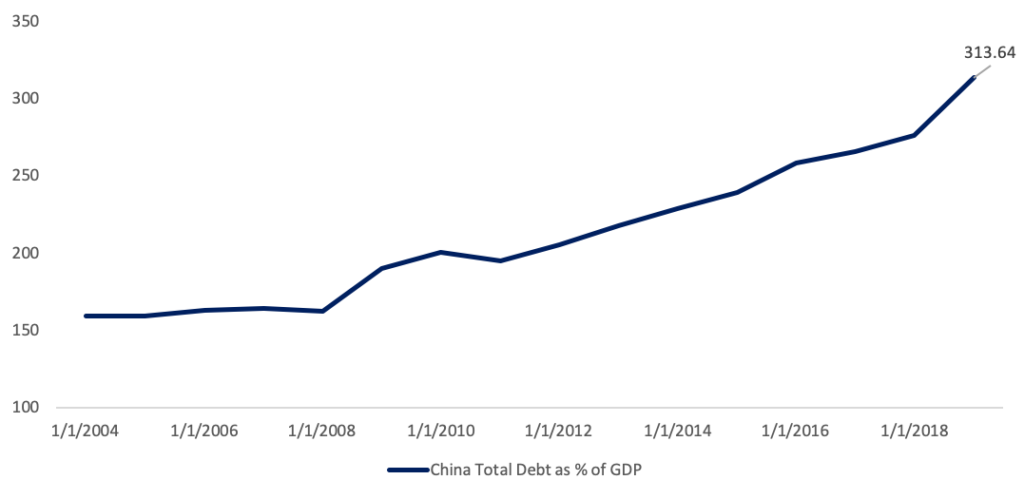

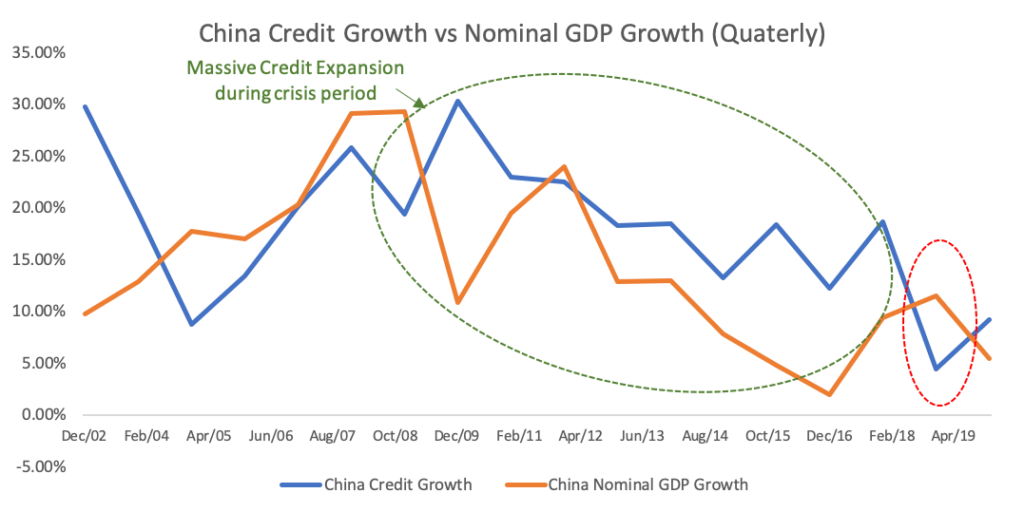

Since 2008, though, the overall credit in the Chinese system has growth at a very high pace, easily exceeding GDP growth.

Since 2008, Nominal Credit Growth in the system has been running very high, well-outpacing Nominal GDP growth. When credit growth runs very high in any economy, there are chances of misallocation of capital and rising bad loans.

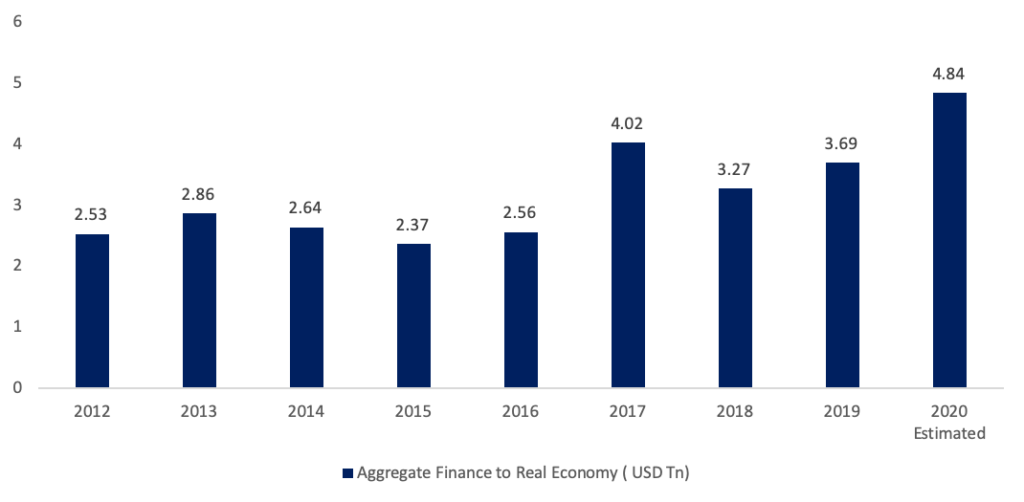

| 2. China Aggregate Financing |

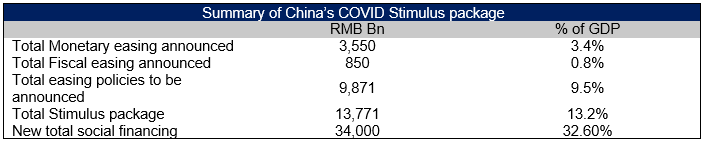

The extent of debt backed stimulus in the country can be seen in the aggregate financing numbers. Total social financing is expected to increase to USD 4.8 Tn in 2020. China has been manufacturing and investment dependent economy and the increased credit is expected to be spent mostly on infrastructure across the country.

| 3. Banking sector (including shadow banks) might turn problematic in future |

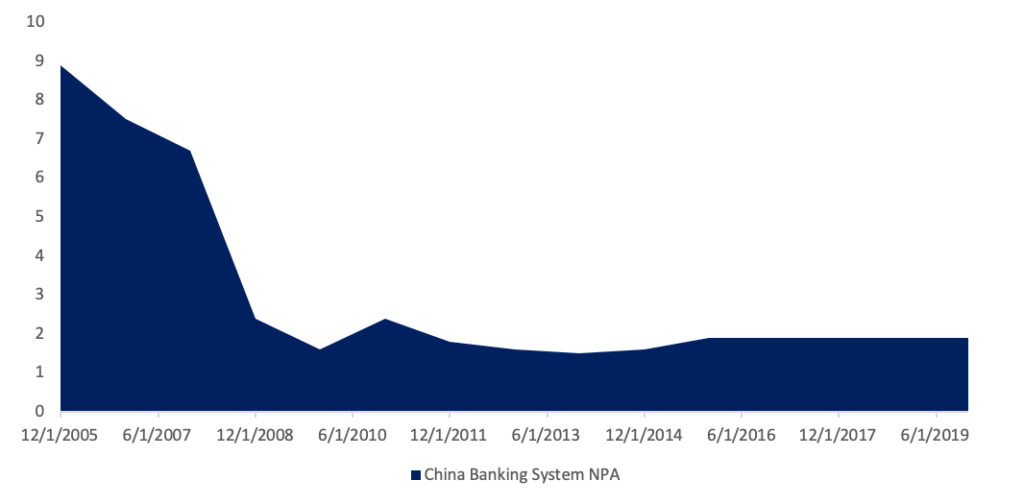

The discussion regarding the stress in shadow banking has been going on for a while now. Due to the COVID induced slowdown, we expect the stress to get magnified in the future. Even the banking sector, which has strong government backing, may show signs of stress in the future. The NPAs reported by the banks do not show the reality.

Currently, the NPA ratio for the banking sector is around 2%, which seems to be very low for a country like China. However, according to a CLSA report, banks have built stronger capital (RMB 4.6 Tn) and provisions (RMB 4.5 Tn) since the GFC. These would enable the banking sector to withstand economic shock better than in the past. According to CLSA, China’s banking system can absorb a 10.3% non-performing loan ratio on a one-off basis without breaking through the minimum capital requirements.

| 4. The Domestic Credit Bubble is Built on Domestic Savings |

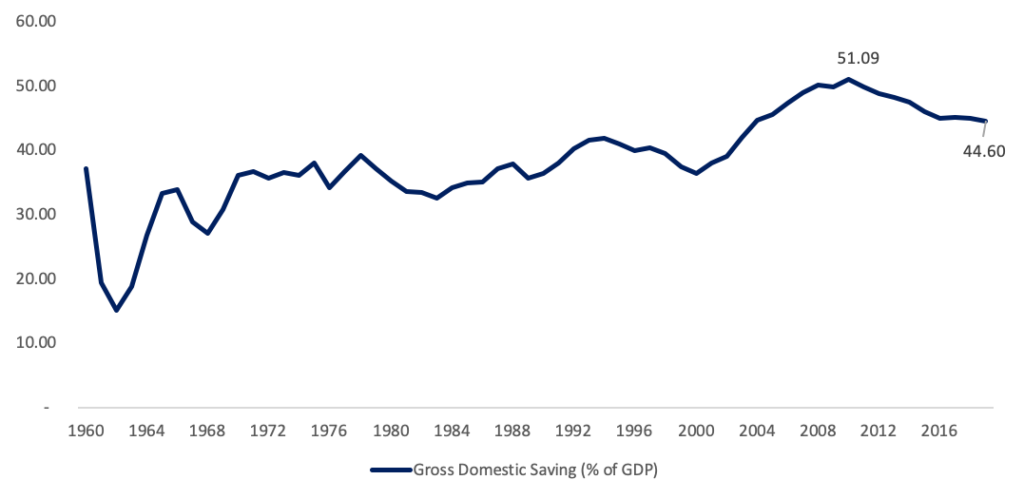

The saving rate in the country has been one of the highest globally. The gross saving rate for the country was around 45% in December 2019. The rate has declined in the past decade from 51% in 2010 but is still driving the domestic economy. This saving is acting as a source of capital, either in the form of credit or investments. Domestic investors primarily hold public debt in the country. Chinese consumers acting as the provider of the capital makes it easier for policymakers to implement and manage economic policies in the country effectively. As long as this saving side of the equation is intact, any credit bubble in the country can be dealt with effectively.

EXTERNAL ECONOMY: Strong, but not as strong as it was 5-6 years ago

| 1. China still controls its Balance of Payments situation |

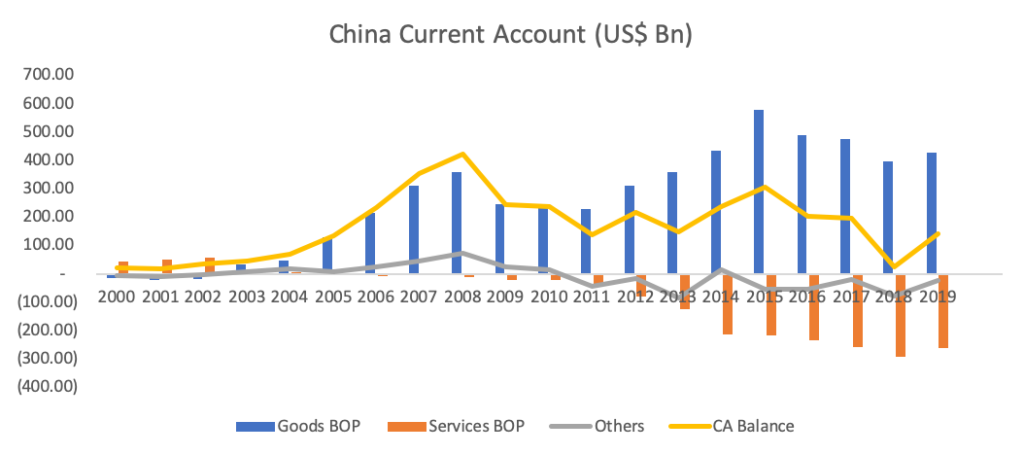

China runs a Current Account Surplus. In simple words, it produces what the world requires and is building surpluses as a country.

As can be seen from the below chart, while Current Account is still a surplus, it is less than 5-6 years ago. China still manufactures a lot of goods which get exported. At the same time, there is money outflow in services such as tourism etc.).

China’s advantage as the world’s manufacturer are hard to match in the short term. So, its Goods Balance of Payments will likely remain favourable for some time. At the same time, we think that the Chinese government can control (or “ration”) the Services Balance of Payments. Hence, this is a lever in China’s control

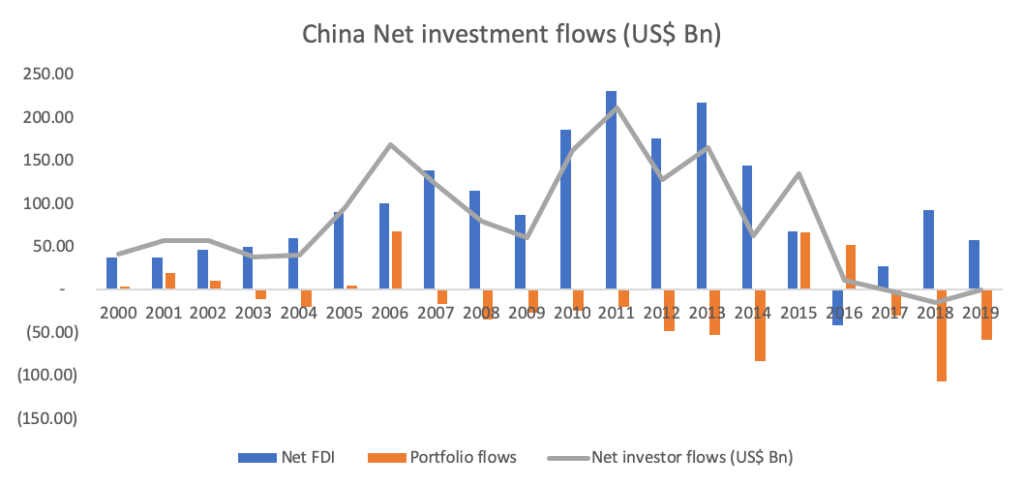

| 2. FDI still remains positive into China |

The foreign investments in the country have been declining for the past few years. While Foreign portfolio investment (investments from foreigners into stock market and bond market) has been negative for the past three years, the “stickier” foreign direct investment is still in positive territory. The steady FDI inflow suggests that foreign investors are positive for medium to long term basis.

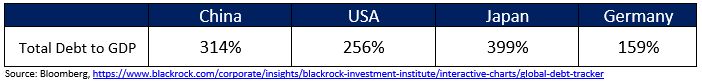

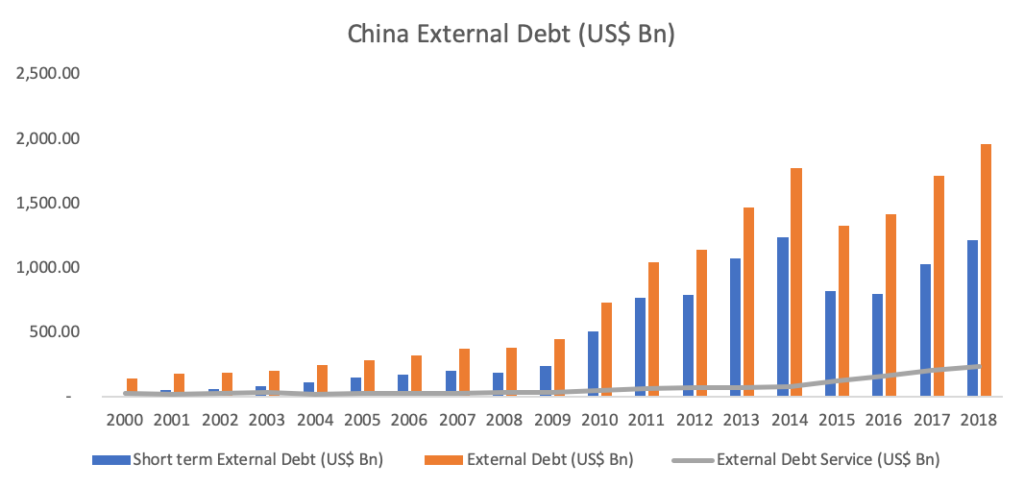

| 3. External debt is very small |

Credit remains one of the prominent forces driving the economy, but most of this is funded domestically. The real issue arises when any country borrows externally to a great extent which is not the case with China.

China’s external debt has been rising for a while, but it hasn’t increased to a level that can cause serious trouble for the country. The country has enough foreign exchange reserves to navigate out of any crisis in the future easily.

| 4. CHINESE YUAN: Not going to be reserve currency but has some fundamental demand |

Given its status as the manufacturing hub for the world, there is inherent demand for its currency. Due to the cheaper labour, raw material, availability of land, and sophisticated infrastructure, the country has attracted low end manufacturing from across the globe.

MOVING UP THE VALUE CHAIN: China has built strong ecosystem and capabilities over the years

| 1. China is moving up the value chain |

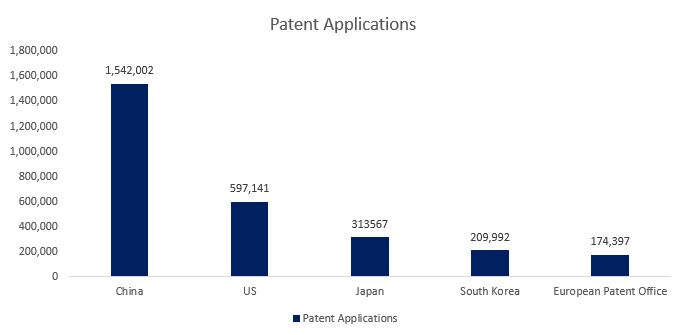

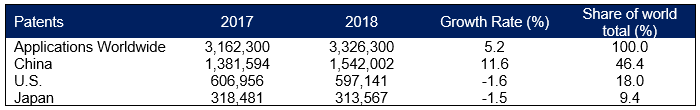

Chinese authorities, as well as Chinese companies, have increased their focus and spending on research and developments. China has been leading the way significantly in terms of patent applications globally. It accounts for around 46.4% of total applications worldwide as of 2018. Also, it accounts for 96.6% of the global utility model applications, 51.4% of the trademark applications, and 54% of the industrial designs.

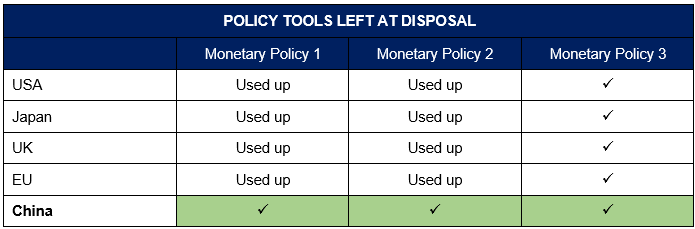

POLICY ROOM-TO-MANOEUVRE: China is still in the very early stage of policy tools

| 1. MONETARY POLICY: China has lot of room for manoeuvre |

According to Ray Dalio, CIO of Bridgewater, Monetary policies can be divided into three types—

- Monetary Policy 1: Interest-rate-driven monetary policy. It is called Monetary Policy 1 because it is the first to be used and is the preferable way to run monetary policy. Once interest rates hit the lower-bound (zero), this policy becomes ineffective.

- Monetary Policy 2: Printing money and buying financial assets, most importantly bonds which is called Monetary Policy 2 and is now popularly called “quantitative easing”. This was widely followed by the developed nations since 2008.

- Monetary Policy 3: Coordination between fiscal policy and monetary policy in which the central government does a lot of debt-financed spending and the central bank buys that debt. It is called Monetary Policy 3 because it is the third and last approach to be used when the first two cease to be effective in doing what needs to be done). We are seeing this play out since March 2020 across the US, UK and Europe. Japan has been doing this for a while.

China still has all the conventional Monetary Policy tools at its disposal.

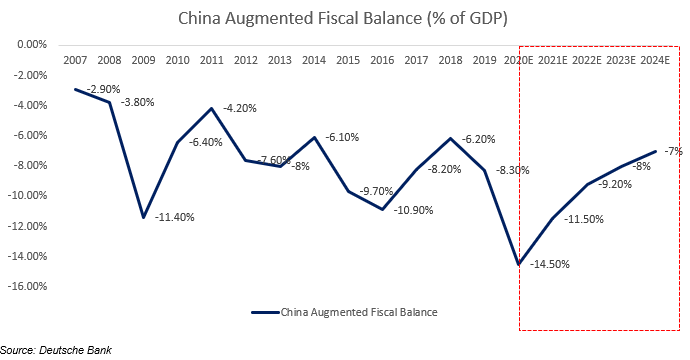

| 2. Country running fiscal deficit now |

China was running a small fiscal deficit during 2008 crisis. Deutsche Bank tracks a broader measure of Fiscal deficit for China. On that, the country has been running a fiscal deficit, which will increase in the future due to the stimulus provided by the government.

Public debt sustainability will unlikely become an issue in the short term, given that public debt structure is predominantly RMB-based and primarily held by domestic investors.

Post-COVID 19, China has started using both Monetary easing as well as Fiscal policy actions.

CONCLUSION: China is relevant; It provides unique diversification to Global Investors

China is a force to reckon with. It is becoming increasingly important in all aspects – geopolitics, economic, military etc. It has a different political system to the rest of the world. Its drivers of success, its history, its culture etc are very different from the rest of the world. Purely from an investor’s perspective, we see China offering unique diversification benefits to Global investors.

We also acknowledge that China is still an emerging country. There are issues such as underdeveloped tax systems, rule-of-law, lack of transparency etc. Investors should be seeking higher risk-adjusted-return premiums.

We aim to get exposure to China through MSCI Asia-ex Japan ETF, which has c. 50% weightage to China. We will continue to refine this over time.

Disclaimer

The information contained on this article has not been examined or approved by any regulatory authority. Nothing contained in this article shall constitute any investment advice, solicitation or offer by Torch Investment Management Pte. Ltd. (“Torch”).

This article is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. Although the information provided in this article is based upon information that Torch considers reliable and endeavors to keep current, Torch does not assure that the information is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed in this article may change as subsequent conditions vary.

Current Role:

Current Role: